Capital One has officially completed its $35 billion acquisition of Discover Financial Services, a transformational deal that positions the company as the largest credit card issuer in the United States by loan volume.

Finalized on Sunday, May 18, the long-awaited merger unites two powerhouse brands in the financial services industry, marking a strategic move to significantly expand Capital One’s reach in credit, payments, and digital banking.

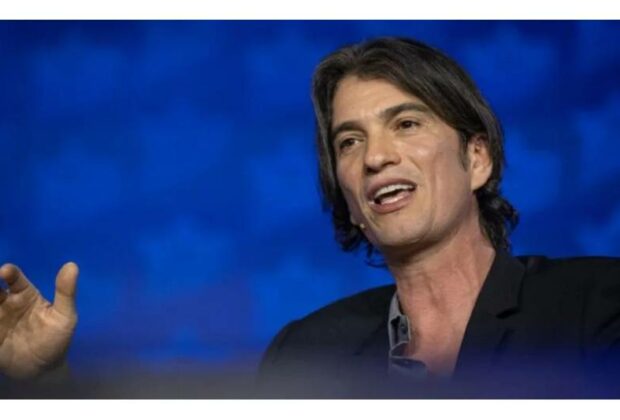

“This deal brings together two innovative, mission-driven companies that together are poised to deliver breakthrough products and experiences,” said Richard D. Fairbank, Founder and CEO of Capital One. “We are well-positioned to continue our quest to change banking for good for millions of customers.”

The merger was first announced in February 2024 and received regulatory approvals from the Federal Reserve, Office of the Comptroller of the Currency, and the Delaware State Bank Commissioner.

Despite regulatory clearance, the deal faced opposition from some lawmakers. Rep. Maxine Waters and Sen. Elizabeth Warren urged the Federal Reserve to reconsider, citing potential negative effects on consumers and small businesses.

“Merchants would have no choice but to accept the terms dictated by Capital One’s network,” they warned, expressing concerns about reduced competition in the payments industry.

Still, the merger proceeded, giving Capital One significant leverage. Through Discover’s independent payments network, Capital One can now compete directly with Visa and Mastercard, two giants that have long dominated the global payments landscape.

The acquisition not only scales Capital One’s credit card business but also strengthens its capabilities in cross-border commerce and payments technology. By owning Discover’s infrastructure, Capital One accelerates its vision to build a fully integrated payments ecosystem.

In related news, Capital One recently agreed to a $455 million settlement in a lawsuit regarding misleading interest rates offered on its 360 Savings accounts—highlighting the company’s ongoing regulatory and consumer-facing challenges.

Read Full Article