Johnson and Johnson said Wednesday it would purchase robotic surgery firm Auris Health for $3.4 billion in cash.

The buy gives J&J, one of the world’s biggest producer of health products, an entry into robotics and expands on the organization’s partnership with Alphabet’s Verily.

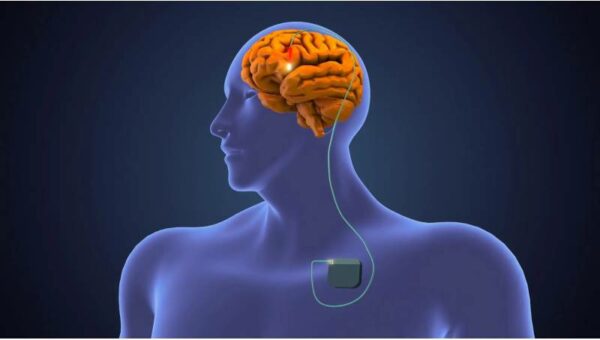

“In this new era of health care, we’re aiming to simplify surgery, drive efficiency, reduce complications and improve outcomes for patients, ultimately making surgery safer,” said Ashley McEvoy, company group chair of consumer medical devices, in a press release. “Collectively, these technologies, together with our market-leading medical implants and solutions, create the foundation of a comprehensive digital ecosystem to help support the surgeon and patient before, during and after surgery.”

The organization is partitioned in three fundamental business units: pharmaceuticals, medical devices and consumer products. J&J’s medicinal gadget business has been lagging, with deals falling 4 percent to $6.67 billion in the final quarter of 2018. The health-care organization has promised to enhance execution through acquisitions and divestitures.

A year ago, J&J divested its LifeScan blood glucose monitor business subsequent to leaving the insulin pump market.

Bloomberg revealed a month ago that J&J was pursing an acquisition of Auris Health, a secretly held designer of robotic technologies. J&J said Wednesday it’s making an “connected digital ecosystem” that utilizes information and robotic technology to manage surgeon through strategies and enhance patient treatment.

The surgical instruments business is required to achieve more than $12 billion by 2025, with the greatest players in the space including J&J, Medtronic, and Intuitive Surgical.

J&J CEO Alex Gorsky noted in a final quarter profit consider a month ago that speculators would see “continued news about our robotics platform over the course of 2020 and beyond.”

“What we want to make sure is that we get out in a timely manner,” he said, “but that we’re also out in a manner that ensures we’re competitive and ensures, ultimately, that we’re making an even bigger difference in this area as we go forward.”

The exchange is relied upon to near as far as possible of the second quarter of 2019.

J&J’s stock was marginally higher in premarket exchanging Wednesday. The stock is up almost 4 percent since the start of this current year. Shares are in excess of 2 percent higher throughout the most recent a year.