Tag: China

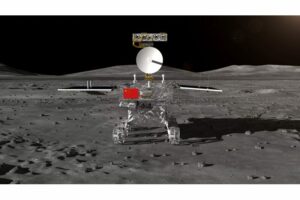

China has successfully recovered over two kilograms of lunar material from the moon’s far side,…

At an event in Xian tonight, BYD’s new fifth generation DM system—which the car uses—was…

The much awaited luxury version of the 2024 Skyworth EV6 520 has debuted in China,…

When compared to the same period in the current fiscal year, India’s airline seat capacity…

As required by China’s Personal Information Protection Law, Asiana Airlines declared on Monday that it…

Since Xiaomi made its market debut for electric vehicles public in 2021, rumours regarding the…

Tesla China appears to be stepping it up with just a few days until the…

At the center of our planet, scientists in China have discovered that the Earth’s inner…

One of the largest phone makers in China, Vivo unveiled their flagship models just a…

Portage Motor Co. started following through on Sunday in China its first Mustang Mach-E SUVs…